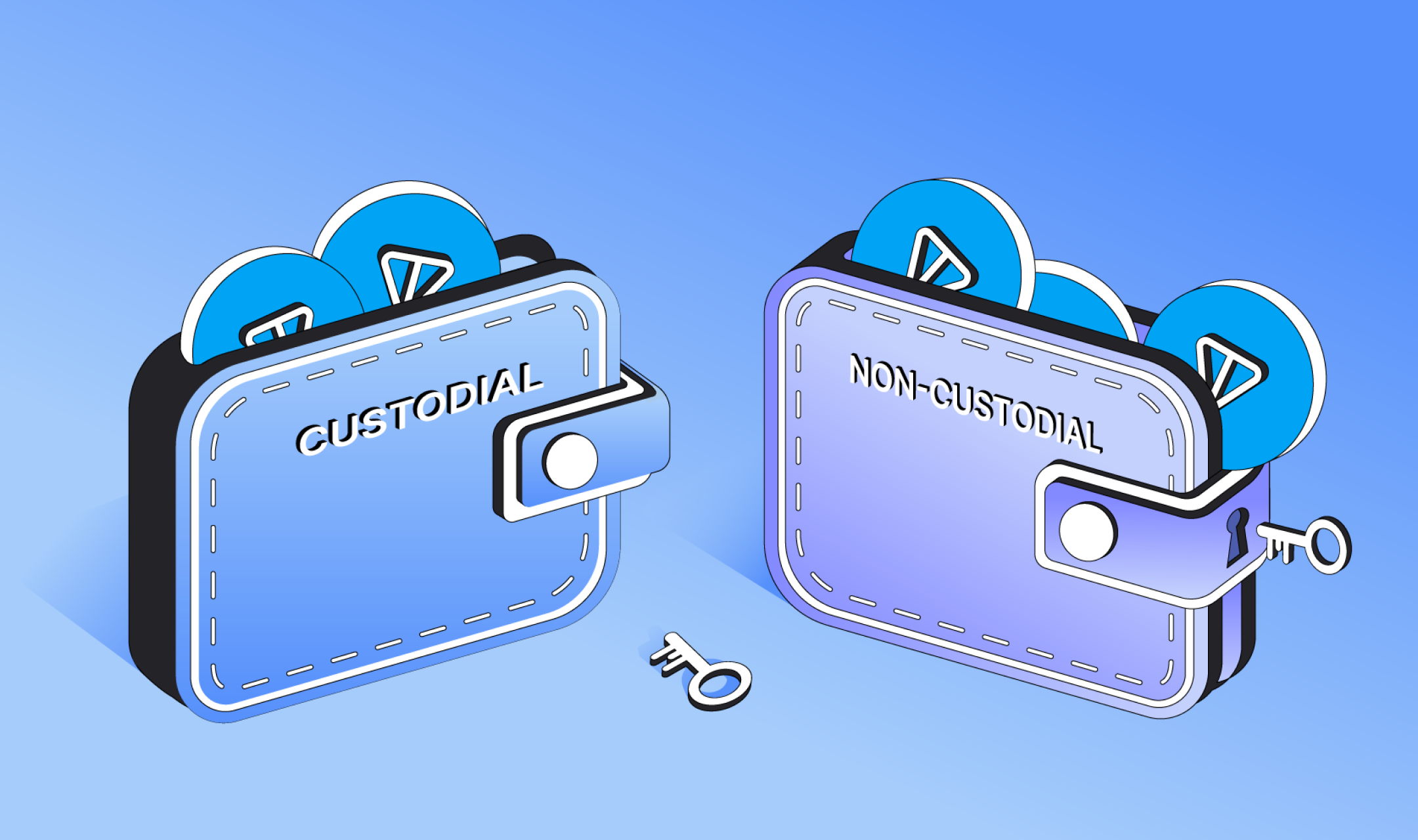

Custodial and Non-Custodial Wallets

This article provides an in-depth exploration of these two types of wallets, clarifying their definitions, advantages, and drawbacks, and examining their suitability for different needs.

Whether you are an experienced investor, a newcomer to the crypto space, or simply interested in the topic, gaining a clear understanding of custodial versus non-custodial wallets will help you make more informed decisions in today’s digital age.

Custodial vs. Non-Custodial Wallets: What They Are and How They Differ

Custodial Wallets

Custodial wallets are services where a third party, such as a financial institution or cryptocurrency exchange, is responsible for holding and managing your private keys.

In this model, you transfer your cryptocurrencies to an address provided by the custodian. The custodian then takes on the role of safeguarding, managing, and securing your assets.

Prominent examples of custodial services include major centralized exchanges like Coinbase and Binance. When you deposit cryptocurrency into your account on these platforms, the exchange holds and manages the funds on your behalf. Unlike non-custodial solutions, you do not have direct access to your private keys with these services; instead, the security and management of your assets are handled by the platform itself. This is similar to how traditional banks operate—once your money is deposited, it is no longer under your direct control.

Non-Custodial Wallets

The concept of “Not your keys, not your coins” is fundamental in the world of cryptocurrency. Non-custodial wallets and services are designed to ensure that you retain ownership of your private keys and, consequently, your crypto assets. In this model, the responsibility for the security, safekeeping, and management of your assets rests solely with you.

Non-custodial solutions involve storing your assets in wallets where only you have access to your private keys. This setup allows you to manage, send, and receive your cryptocurrencies independently, without relying on intermediaries or third-party services.

Prominent examples of non-custodial solutions include hardware wallets such as Ledger and Trezor, as well as software wallets like Tonkeeper and Trust Wallet. With these options, you retain full control over your private keys and your assets. No external party can access or manage your funds without your explicit authorization, which is protected by your private key.

Custodial Wallets

Advantages:

- Enhanced Security: Centralized custodial services typically invest significantly in robust security measures to safeguard large volumes of assets. This can offer a higher level of security compared to what many users could achieve on their own, particularly for those less familiar with technology.

- User-Friendly Experience: For those new to cryptocurrencies, custodial solutions often provide a more straightforward and intuitive interface. These platforms manage complex processes behind the scenes, simplifying tasks like trading, withdrawing, and depositing for users.

- Customer Support: Custodial services generally offer customer support teams available to help with issues such as lost passwords or transaction problems.

- Regular Updates and Features: Many custodial platforms regularly update their systems with new features, improved user interfaces, and additional functionalities to enhance user experience.

Disadvantages:

- Centralization Risks: Centralized custodial platforms, such as exchanges, can be prime targets for hackers. Centralization also introduces a single point of failure, which can pose risks.

- Limited Control: In custodial solutions, you do not have direct control over your assets. The platform manages your funds, and you must rely on its integrity.

- Potential Censorship and Restrictions: Custodial platforms can freeze accounts or restrict access to funds under certain circumstances, such as government requests, suspicious activities, or their own policies.

- Privacy Issues: Centralized platforms often link your identity to your accounts, which can expose your transaction history and balances more than in non-custodial solutions.

Non-Custodial Wallets

Advantages:

- Complete Control: You retain full authority over your assets. No third party can access or manage your funds without your private key or the device where they are stored.

- Resistance to Censorship: With no central authority overseeing transactions, there is a lower risk of your funds being frozen or restricted.

- Increased Privacy: Non-custodial solutions offer greater privacy since there is no central entity tracking all transactions. Although blockchain transactions are generally public, the identities associated with these transactions can remain pseudonymous.

- Reduced Intermediary Risks: You face fewer concerns about the platform going offline, being compromised by hackers, or encountering regulatory issues that could impact your assets.

Disadvantages:

- Increased Personal Responsibility: The burden of security falls entirely on you. Losing access to your private keys means losing access to your assets.

- Learning Curve: Non-custodial wallets can be challenging for beginners to navigate. It is crucial to understand seed phrases, private keys, blockchain mechanics, and security practices.

- Limited Support: If an error occurs, such as sending funds to an incorrect address, there is typically no way to recover your assets, and support options may be minimal or non-existent.

- Risk of Loss: Poor management, forgotten credentials, or falling victim to scams can lead to irreversible loss of assets. In non-custodial systems, the security of your funds depends heavily on how well you protect and manage your private keys and recovery seed.

As proponents of decentralized and censorship-resistant solutions, we encourage exploring non-custodial wallets. If you decide to use one, here are some tips to help you become an independent and secure crypto holder.

Security Guidelines for Non-Custodial Wallets

Regular Backups: Make sure to frequently back up your wallet and keep these backups in multiple secure locations to protect against data loss.

Utilize Hardware Wallets: For holding substantial amounts of cryptocurrency, consider using a hardware wallet. These devices keep private keys offline, offering protection against online threats.

Verify Addresses: Always double-check the recipient’s address before transferring funds. Malware can alter copied addresses, so it’s essential to verify the full address thoroughly. Avoid relying solely on the initial and final characters, as malicious addresses can mimic these characters. Verify the entire address twice to ensure accuracy.

Keep Software Updated: Regularly update your wallet software. Developers release security patches and updates, so maintaining the latest version is crucial for safeguarding your assets.

Guidelines for Storing and Securing Your Private Keys and Recovery Seed

Physical Security: Record your recovery seed on paper and store it in a secure place, such as a safe or safety deposit box. Consider using durable materials like steel for recovery seed backups, which offer resistance to natural elements and time, such as CryptoSteel or CryptoTag.

Avoid Digital Copies: Refrain from taking photos or screenshots of your recovery seed, as these can be vulnerable to online threats, especially if stored on internet-connected devices. Prefer physical backups or secure recordings.

Use Tamper-Evident Bags: Place your written recovery seed in tamper-evident bags to detect any unauthorized access attempts.

Create Multiple Copies: Make several copies of your recovery seed and store them in different secure locations. This redundancy ensures that if one copy is lost or damaged, others remain available. For added security, consider splitting the seed (words) into separate locations.

Keep it Confidential: Your recovery seed is crucial for accessing your funds. Do not share or expose it, as this could lead to a loss of assets. Only trusted individuals should know its location and contents.

As digital assets become more mainstream, understanding and implementing robust storage solutions is vital. By following these guidelines, you can ensure the security and accessibility of your holdings.

Conclusion

In the swiftly advancing realm of cryptocurrencies, choosing between custodial and non-custodial options is more than just a matter of preference—it’s a balancing act between convenience and self-reliance.

As we’ve explored, both approaches offer distinct advantages and drawbacks. The ideal choice often hinges on your familiarity with the technology, desired level of control, and tolerance for risk. With decentralization at the heart of the cryptocurrency revolution, non-custodial solutions align closely with the principles of digital assets. However, they also entail significant responsibilities.

There is no need to feel obligated to adopt non-custodial wallets if custodial services better fit your needs. Ultimately, the decision is yours, and protecting your assets and private information is paramount.

Conduct thorough research, consult various sources, and evaluate your circumstances to determine which option aligns best with your requirements.

Stay alert and secure!