By staying informed, you can fully enjoy the benefits of TON and Telegram while minimizing risk.

Common Scams to Avoid

Impersonation Scams: Fraudsters may pose as friends or family, urgently requesting money. Always verify their identity before responding.

Phishing Schemes: Fraudulent websites may mimic legitimate ones to steal login credentials. Double-check URLs and avoid clicking on unsolicited links.

Investment Fraud: Promises of high returns with no evidence are common in crypto scams. Conduct thorough research—if it seems too good to be true, it likely is.

Survey Scams: Offers claiming prizes for survey participation may be attempts to gather personal information. Avoid sharing your details with unfamiliar survey requests.

Job Offer Scams: Be cautious of enticing job advertisements that request personal information or payments. Verify these offers through official channels.

Classified Ad Scams: Fake ads may direct you to deceptive Telegram bots designed to collect personal information.

Pump and Dump Schemes: Some groups artificially inflate crypto prices to profit, leaving others with losses. Always research and verify investment recommendations.

Romance Scams: Scammers in online relationships may request money or personal details. Exercise caution with online acquaintances asking for financial assistance.

Be Aware of Toncoin Pyramid Schemes

The support Telegram provides for the TON Blockchain has unfortunately attracted scammers seeking to exploit naive users. Here’s a detailed look at a typical scam:

Initial Setup: Scammers distribute links to “exclusive earning programs” that appear to come from trusted contacts. They direct users to join an unofficial Telegram bot, falsely claiming it’s for secure cryptocurrency storage.

Investment Phase: Users are encouraged to buy Toncoin through legitimate channels like Wallet, P2P markets, or exchanges, lending the scam false credibility. Once acquired, users are instructed to transfer their Toncoin to the scam bot.

Booster Purchases: Victims are urged to buy “boosters” through a separate bot, costing between 5 to 500 Toncoin. At this stage, users lose their cryptocurrency.

Recruitment Efforts: Scammers promote a referral scheme, asking users to set up private Telegram groups and recruit friends. They promise earnings from a fixed payment of 25 TON per referral and commissions based on the boosters purchased by referrals.

In reality, this is a classic pyramid scheme where the scammers profit at the expense of others.

Tips for Staying Safe

To protect yourself from online fraud and ensure the security of your Telegram account, follow these essential practices:

Enable Two-Step Verification: Go to Settings > Privacy and Security > Two-Step Verification to add an extra layer of security to your Telegram account.

Verify Contacts: Be cautious of unsolicited requests for personal information or money. Confirm the identity of the sender through alternate means.

Regularly Review Account Activity: Check Settings > Devices > Active Sessions to identify any unknown devices or sessions accessing your account.

Report Suspicious Activity: If you encounter a scam, report it to Telegram immediately.

Avoid Get-Rich-Quick Schemes: Exercise caution with schemes, even if recommended by acquaintances—they may unknowingly be victims themselves.

Verify Cryptocurrency Transfers: Always ensure you are sending cryptocurrency to a verified recipient to avoid scams.

Staying secure on TON and Telegram requires vigilance and awareness. By recognizing common scams and adhering to these safety tips, you can safeguard your assets and personal information. Always verify sources, be wary of overly promising offers, and use only official channels for transactions. By staying informed and cautious, you can enjoy the advantages of TON and Telegram without falling prey to fraud.

Harnessing Python with TON

TON offers a decentralized layer-1 blockchain renowned for its rapid and efficient transactions. Despite its advantages, the FunC and Fift programming languages associated with TON can be quite challenging for developers to master. Enter Rift.

Rift enables developers to harness the power and flexibility of Python to create and interact with TON. With Python’s intuitive syntax and object-oriented programming (OOP) capabilities, developers can easily write and test smart contracts without the need to acquire a new programming language.

Rift serves as the gateway connecting Python with the world of TON.

Streamlining Development with Rift

Rift provides a comprehensive set of tools for developing on TON. It simplifies the entire development workflow, from crafting smart contracts in Python to testing and deploying them on the TON network. With Rift’s all-in-one framework, developers only need to be familiar with Python 3.10 to start creating on TON.

Here are a few of the standout features that make Rift an essential resource for TON development:

Enhance Your Smart Contract Creation with Rift

Rift allows developers to leverage Python’s syntax and features to effortlessly build smart contracts for TON. There’s no need to master a new programming language or deal with compatibility challenges—Rift integrates the strengths of Python with TON, making blockchain development more accessible and efficient.

Class Definition

class SimpleWallet(Contract):

"""

Simple Wallet Contract.

# config

get-methods:

- seq_no

- public_key

"""

Data Model

The SimpleWallet class includes an inner class called Data, which is a model representing the contract’s state. It has two attributes:

- seq_no: A 32-bit unsigned integer that tracks the sequence number of transactions.

- public_key: A 256-bit unsigned integer that stores the public key used for verifying signatures.

class Data(Model):

seq_no: uint32

public_key: uint256

External Body

The ExternalBody class represents the structure of external messages received by the contract. It includes:

- seq_no: A 32-bit unsigned integer matching the sequence number in the contract’s state.

- valid_until: A 32-bit unsigned integer indicating the expiration time of the message.

class ExternalBody(SignedPayload):

seq_no: uint32

valid_until: uint32

Contract Data

The SimpleWallet class maintains a single instance of Data to track the current state of the wallet.

External Message Handling

The external_receive method processes incoming messages. The method performs the following steps:

- Parse the Message: It extracts the message body as an ExternalBody instance.

- Verify Validity:

- Checks if the message’s valid_until timestamp is greater than the current time.

- Verifies that the seq_no in the message matches the current sequence number in the state.

- Validates the message’s signature using the stored public key.

- Accept the Message: If all checks pass, the message is accepted.

- Process References: It handles any references within the message, sending them as raw messages with the specified mode.

- Update State: Increments the sequence number and saves the updated state.

This contract exemplifies a simple wallet system with basic functionality for managing and verifying transactions in a blockchain environment.

Mastering TON Interaction with Rift

Rift offers a comprehensive solution for working with TON, simplifying every aspect of network engagement. It consolidates all essential TON development tools into a single interface, making it incredibly straightforward for developers to:

- Create Messages: Easily construct and manage messages within the TON network.

- Sign Messages: Utilize the Fift backend to securely sign messages.

- Execute Contracts: Run and test contract codes efficiently.

- Deploy Contracts: Seamlessly deploy smart contracts to the network.

- Engage with the Network: Use the Tonlibjson backend for smooth network interactions.

With Rift, developers can streamline their workflow and fully harness the capabilities of the TON network.

from contracts.jetton_minter import JettonMinter

from contracts.jetton_wallet import JettonWallet

def deploy():

# Initialize the data for the JettonMinter contract

init_data = JettonMinter.Data()

init_data.admin = "EQCDRmpCsiy5fA0E1voWMpP-L4SQ2lX0liTk3zgFXcyLSYS3"

init_data.total_supply = 10**11 # This represents a total supply of 100

init_data.content = Cell() # Set content to an empty cell

init_data.wallet_code = JettonWallet.code() # Retrieve the code for the JettonWallet

# Deploy the JettonMinter contract with an initial amount

msg, addr = JettonMinter.deploy(init_data, amount=2 * 10**8)

# Return the deployment message and a boolean value (False)

return msg, False

Thoroughly Validate Your Contracts

Rift offers a comprehensive testing framework for the TON Virtual Machine (TVM), simplifying the process of validating contracts before their deployment on the main network. This framework delivers an intuitive interface for crafting message bodies and examining the contract’s state to verify its functionality.

from contracts.jetton_wallet import JettonWallet

from contracts.types import TransferBody

def test_transfer():

# Create and initialize wallet data

data = create_data().as_cell()

wallet = JettonWallet.instantiate(data)

# Prepare the transfer body

body = create_transfer_body(dest=3)

# Send tokens and check the result

result = wallet.send_tokens(

body.as_cell().parse(), MsgAddress.std(0, 2), int(10e9), 0

)

result.expect_ok()

def test_transfer_no_value():

# Create and initialize wallet data

data = create_data().as_cell()

wallet = JettonWallet.instantiate(data)

# Prepare the transfer body

body = create_transfer_body(dest=3)

# Attempt to send tokens with zero value and check for an error

result = wallet.send_tokens(

body.as_cell().parse(), MsgAddress.std(0, 2), 0, 0

)

result.expect_error()

In this code:

- test_transfer() initializes a JettonWallet instance and performs a token transfer. It then verifies that the transfer was successful.

- test_transfer_no_value() initializes a JettonWallet instance and attempts to send tokens with a zero value, checking that an error is returned.

Embrace the Future with TON

TON has the power to transform the blockchain landscape, and Rift is the ideal tool to harness its full potential. Whether you’re new to TON or a seasoned developer, Rift offers a streamlined approach to accelerate your development and realize your ideas on the TON network. Don’t miss out—start building with Rift today and become part of the TON transformation!

Begin Your Journey Today

Dive into Rift’s repository and join the Skyring Channel to stay up-to-date with the latest developments. We’re thrilled to announce that comprehensive guides will be available soon. Keep an eye out for more information!

If you’ve worked with smart contracts before, you’ll probably know about Ethereum’s Solidity language and the EVM. As you start looking into TON development, it’s important to understand the different design choices that lead to different behaviours compared to what you might expect from Ethereum. This post aims to outline some of these key differences and provide insights into the rationale behind them.

Transitioning from Data to Big Data

The key to understanding TON is recognizing that it was engineered to bring blockchain technology to billions of people worldwide. This requires an immense scale, with the potential for billions of users conducting billions of transactions daily.

Consider this shift as moving from managing standard data to handling big data. For example, storing a restaurant’s menu in an SQL database is effective because it allows for powerful and flexible queries with all the data easily accessible. However, when it comes to storing every Facebook post made by billions of users globally, an SQL database is no longer a viable option. In this context of “big data,” aggressive sharding is necessary, which in turn limits the flexibility of the queries you can perform. It’s a matter of making different trade-offs to meet different objectives.

Here are six distinctive features of the TON blockchain that might surprise Solidity developers:

- Smart Contracts Must Pay Rent and Charge Users

The idea of using blockchain as a permanent, unchangeable storage solution is appealing in theory but proves challenging when scaled. Ethereum’s fee model is akin to that of a bank: when you send money, you pay a transaction fee, and the user who initiates the transaction covers this cost. Similarly, when you deploy a new smart contract on Ethereum, the sender of the deployment transaction pays a one-time fee. However, since the data on the blockchain is intended to be permanent, miners bear the ongoing infrastructure costs to maintain it indefinitely. This economic model becomes unsustainable at scale, especially when considering billions of users.

- From a Bank Model to an Instant Messenger Approach

TON takes a different approach to fees, drawing inspiration from web apps like instant messengers rather than banks. For example, when you send a message on Facebook Messenger, you don’t directly pay a fee. Instead, the app developer (Facebook Inc., now Meta) covers the cost, and it’s up to them to recoup these expenses and sustain the platform.

Similarly, in TON, the dapp itself must cover its resource costs. Each smart contract holds a balance of TON tokens, which it uses to pay for rent. If the smart contract runs out of funds, it will eventually be removed from the blockchain (though recovery is possible). Unlike Ethereum, where storage fees are paid only once, TON’s model requires continuous rent payments. This means that the longer data is stored, the more it costs, aligning better with the ongoing expenses miners incur, and making it more scalable.

- Flexible Funding Options for Developers

Just as Facebook Inc. has various ways to fund its operations, developers on TON have significant flexibility in financing their smart contracts. They can choose to subsidize the contract out of their own TON tokens or charge users gas fees for specific actions, using those fees to cover future rent payments. This flexibility allows developers to tailor their economic models according to their dapp’s needs and ensures a more sustainable operation over time.

- Smart Contract Interactions in TON Are Asynchronous and Non-Atomic

One of Ethereum’s greatest strengths in fostering a robust DeFi ecosystem is the smooth composability of smart contracts. Within a single transaction, you can perform complex operations such as using WBTC as collateral in a Compound contract, borrowing USDC, trading it on Uniswap for more WBTC, and leveraging your position—all in one go. This entire process is atomic, meaning that if any step fails, the entire transaction is rolled back as if it never occurred.

In Ethereum, when a smart contract calls a function on another smart contract, the call is executed immediately within the same transaction. This synchronous execution is akin to running your entire backend on a single server, where every component can directly and instantly interact with every other component. This approach is straightforward to manage and reason about but has a significant limitation: scalability. The system can only expand as long as everything remains within that single environment.

In contrast, TON handles smart contract interactions differently. Calls between smart contracts are asynchronous and non-atomic, meaning that when one contract calls another, the call doesn’t happen immediately within the same transaction. Instead, the process is broken up, and each step occurs independently. If something goes wrong in one step, the other steps don’t automatically roll back. This design is more scalable but requires developers to approach contract interactions with a different mindset, considering the potential delays and non-reversibility in the process.

Transitioning from a Single Server to a Microservices Cluster

If you think of Ethereum as a monolithic system running on a single server, TON is more akin to a cluster of microservices. In this setup, each smart contract might be running on a different machine. When two smart contracts need to communicate, they do so by sending messages across the network, much like microservices in a distributed system. Because these messages take time to travel, communication between contracts becomes asynchronous. This means that when your smart contract calls a method on another contract, the call is processed after the transaction is complete, in a subsequent block.

This asynchronous model introduces complexities that are not present in Ethereum’s synchronous environment. For instance, what if the conditions change between the time a message is sent and when it is received? Imagine a scenario where the balance of the calling contract has altered by the time the second contract processes the call. Ensuring consistency becomes more challenging, and the likelihood of bugs increases. Additionally, atomicity—where a series of operations either all succeed or all fail—no longer happens automatically. If you chain multiple calls and the last one fails, you’ll need to manually roll back the previous changes, adding another layer of complexity to smart contract development on TON.

- Your Smart Contract Can’t Directly Query Other Contracts

This limitation is a direct consequence of the asynchronous nature of contract interactions in TON. In Ethereum, where contract calls are synchronous, reading data from another smart contract is straightforward. For example, if your contract needs to know its balance of USDC, it simply calls the getBalance method on the USDC contract.

Returning to the analogy of a monolithic system running on a single server, one of the advantages is that every service can instantly access the state of any other service. This makes querying data between contracts in Ethereum easy and efficient. However, in TON, where contracts operate more like separate microservices, this direct access isn’t possible. Instead, retrieving data from another contract requires sending a message and waiting for a response, which complicates the process and introduces delays.

Shifting from a Single Server to a Microservices Cluster

In a system where separate microservices run on different machines, direct access to state memory across services becomes impossible. On TON, smart contracts can only interact by sending asynchronous messages. If your contract needs to query data from another contract and requires an immediate response, you’re out of luck.

The situation gets even more peculiar. If you come across getter methods on a TON smart contract, such as getBalance, these methods aren’t accessible from other smart contracts. Instead, getter methods are designed to be called only by off-chain clients, much like how an Ethereum wallet might use a service like Infura to query the state of any smart contract.

- Smart Contract Code on TON Is Not Immutable and Can Be Easily Modified

The concept of dapps on Ethereum draws inspiration from legal contracts, where the terms are set in stone once agreed upon—hence the term “smart contracts.” In this analogy, the developer writes the terms of the contract as code, and that code becomes the unchangeable law. In the real world, when two parties sign a contract, the agreement is fixed, and any changes require drafting a new contract.

Following this philosophy, Ethereum’s smart contract code was designed to be immutable, meaning it cannot be altered once deployed. However, over time, developers have found ways to work around this limitation by employing complex patterns, such as using proxy contracts that delegate calls to another contract, thereby allowing for upgrades without changing the original contract’s code.

In contrast, TON takes a different approach. The code of smart contracts on TON is not inherently immutable and can be modified more easily. This flexibility allows developers to update and improve their contracts without resorting to convoluted workarounds, making the process of upgrading smart contracts more straightforward on the TON blockchain.

Shifting from Legal Contracts to Software Engineering

Unlike lawyers, who assume that contracts are set in stone, software engineers understand that every piece of code is prone to bugs, and even if the code were flawless, requirements often evolve, necessitating updates and modifications.

In TON, the notion that smart contracts must be immutable is entirely abandoned. Smart contracts on TON can freely modify their own code, just as they would any other state variable. If a contract writes to its code variable, it becomes mutable; if it doesn’t, it remains immutable. This approach simplifies the process, eliminating the need for complex proxy patterns and making it easier to update and maintain smart contracts.

- Avoid Unbounded Data Structures in Your Contract State

This concept can be challenging to grasp at first, but it’s essential for understanding why certain smart contracts on TON are designed in specific ways.

Unbounded data structures in smart contracts are state variables that can grow without limit. Take, for example, an ERC20 contract like the one implementing the USDC token. This contract needs to maintain a mapping of user addresses to their respective balances. Since USDC can be minted in large quantities and divided into small fractions, the number of holders—and thus the number of entries in this map—can increase indefinitely.

Now, consider what happens if an attacker tries to overwhelm the contract by continuously adding new entries. Could this lead to a denial-of-service (DoS) attack, preventing legitimate users from interacting with the contract? On Ethereum, this issue is addressed effectively. The fee model requires users who write new data to the contract state to pay a fee for that data. This means that any attacker attempting to spam the contract would incur significant costs. Additionally, the gas cost for writing to a map on Ethereum is fixed, regardless of the map’s size, ensuring that legitimate users are not penalized by the spam.

In summary, Ethereum’s fee structure makes spamming with unbounded data structures economically unfeasible, and the system itself provides a layer of protection.

Transitioning from Unbounded Maps to Unbounded Contracts

For TON smart contract developers, the system doesn’t automatically protect against spamming unbounded data structures within a contract’s state. Unlike Ethereum, where gas fees for writes are constant, TON’s gas fee model makes write costs proportional to the amount of data in the structure. This is due to TON’s “Bag of Cells” architecture, where the contract state is divided into 1023-bit chunks known as “cells,” which the developer must manage. In this setup, maps are implemented as a tree of cells, and writing to a leaf node requires updating hashes along the entire tree. If an attacker spams the map with keys, they could push some user balances deep enough into the tree that updating them exceeds the gas limit.

To mitigate this risk, the best practice in TON is to avoid unbounded data structures in your contract state. This helps protect your contract from potential DoS attacks. The solution typically involves contract sharding: instead of storing an infinite number of user balances in a single USDC contract, you can split the contract into multiple child contracts, each managing the balance of a single user.

This approach explains why, on TON, NFT collection contracts place each item in a separate contract (since the number of items can be unlimited), and why fungible token contracts create individual contracts for each user’s balance.

To understand why TON is designed this way, it’s important to consider the limitations of Ethereum’s gas fee model, where the cost of writing to a map is fixed regardless of the map’s size. While this simplicity works for small maps, as maps grow to billions of entries, the effort required by miners to update them increases significantly, making a more scalable solution like TON’s necessary.

- Wallets Are Smart Contracts, and One Public Key Can Deploy Multiple Wallets

On Ethereum, a user’s wallet is directly tied to their address, which is derived from a public key and its corresponding private key. This creates a one-to-one relationship: one address per public key and one public key per address. As long as the user has access to their private key, they retain control over their wallet.

Moreover, on Ethereum, users don’t need to take any special actions to have a wallet—it’s simply their Ethereum address. This address can store ETH, hold ERC20 tokens and NFTs, and directly interact with other smart contracts by sending and signing transactions.

In contrast, on TON, wallets are actually smart contracts themselves. This means that a single public key can be associated with multiple wallets, each potentially offering different functionalities. As a result, users can deploy several wallets from the same public key, each tailored for specific purposes, providing a level of flexibility and customization not seen in Ethereum’s more straightforward model.

Shifting from Address to Smart Contract

In TON, wallets aren’t automatically provided; they are independent smart contracts that must be deployed just like any other contract. When a new user begins using the TON blockchain, their first task is to deploy a wallet on-chain. The wallet’s address is generated from the wallet contract’s code and various initialization parameters, such as the user’s public key.

This setup allows users to deploy multiple wallets, each with a unique address. These wallets can vary in their underlying code (as new versions are periodically released by the foundation) or in their initialization parameters (one common parameter is a sequence number). As a result, even if a user retains their private key, they still need to remember their wallet address or the specific initialization parameters used during its creation.

When sending a transaction to a dapp on TON, the process differs from Ethereum. The user signs a message with their private key, but instead of sending this transaction directly to the dapp’s smart contract, it is sent to the user’s wallet contract. The wallet contract then forwards the message to the dapp’s smart contract.

This design provides TON with a greater degree of flexibility. The community can develop new types of wallet contracts over time. For example, a wallet without a nonce (transaction sequence number) could be created, allowing multiple transactions to be sent in parallel from different clients without prior synchronization. Additionally, specialized wallets like multi-signature wallets—which on Ethereum require a separate smart contract—can function seamlessly alongside regular wallets on TON.

Introduction to FunC Development: A Step-by-Step Guide

To help you navigate this journey effectively, I’ll provide you with a roadmap and practical tips, guiding you through the lessons so you can gain a solid understanding of FunC and potentially create your own applications on the TON blockchain.

Embarking on the TON Ecosystem

As we set our sights on the TON ecosystem, our journey begins…

Smart Contracts on the TON Blockchain

The TON network is powered by TVMs (TON Virtual Machines), where smart contracts—programs stored on the blockchain—execute when specific conditions are met. The high-level language FunC is used to develop these smart contracts on the TON blockchain. FunC code is compiled into Fift assembler code, which in turn generates the bytecode that runs on the TVM.

Any developer can create a smart contract and deploy it to the TON network by paying a network fee. Users can then interact with the smart contract by executing its code, again for a fee paid to the network.

Through smart contracts, developers have the ability to create and deploy complex user applications and services.

It’s also worth noting that once published, smart contracts are assigned a unique address on the network.

As we venture into the TON ecosystem, the first thing we encounter is a “forest” of cells. To make sense of this and move forward, we need to understand data types, exceptions, and functions in FunC.

Understanding Data Types, Functions, and Exceptions in TON

In the TON Blockchain, all persistent data is stored within trees of cells. Each cell can contain up to 1023 bits of arbitrary data and can reference up to 4 other cells. These cells serve as the memory for the stack-based TON Virtual Machine (TVM).

A FunC program is essentially a collection of function declarations/definitions and global variable declarations. Each function declaration or definition follows a common pattern:

[<forall declarator>] <return_type> <function_name>(<comma_separated_function_args>) <specifiers>

Here, [ … ] denotes an optional component.

Special Functions in TON Smart Contracts

Smart contracts on the TON network have two key reserved methods that can be accessed:

- recv_internal(): This method is triggered when an action occurs within the TON network itself, such as when another contract interacts with yours.

- recv_external(): This method is executed when a request is made to the contract from an external source, outside of the TON network.

Handling Exceptions in Smart Contracts

An essential aspect of any smart contract is the ability to handle errors through exceptions. Exceptions can be triggered by using conditional primitives such as throw_if and throw_unless, or by the unconditional throw primitive.

To help you grasp these concepts, I’ve prepared a lesson where you’ll write your first smart contract and apply the information you’ve just learned in practice. [Link to the first lesson].

Congratulations! You’ve navigated through the “forest” of cells. However, to ensure others can follow the path you’ve created, we’ll need to test it.

Testing a Smart Contract

As you ponder the importance of testing, a wise figure approaches and informs you that there are currently two types of tests in TON.

V1 Tests

In the older V1 testing framework, each test requires the creation of two functions:

- Data Function (or more accurately, a state function)

- Test Function

For each test, you first establish the data or state using the data function. Then, within the test function, you outline the test logic, triggering exceptions whenever the logic is violated.

Although this is the older testing method, the sage encourages you to explore it to gain a deeper understanding of how testing works in TON. You can learn how to test the smart contract you created in the first lesson using V1 tests by following the instructions in the second lesson.

V2 Tests

As the sage departs, he gestures toward the horizon and mentions that TON now has a new testing framework that you should explore if you want to create tests more efficiently.

V2 Testing Framework

In the updated V2 tests, testing is streamlined through two key functions that allow you to invoke smart contract methods:

- invoke_method: Assumes that no exception will be thrown.

- invoke_method_expect_fail: Assumes that an exception will be thrown.

These functions are called within your test functions, which can return multiple values—all of which will be displayed in the test report when the tests are executed.

To distinguish test functions from helper functions, ensure that the name of each test function begins with __test. This naming convention helps identify which functions are tests and which serve as utilities.

Understanding the Stack and Registers in TON

As you delve deeper into the TON ecosystem, it becomes clear that mastering the concepts of registers and the stack is essential. Without this understanding, creating anything meaningful within TON is nearly impossible, making this knowledge a crucial part of your journey through the network.

Stack and Registers in TON

The TON Virtual Machine (TVM) operates as a stack machine, where the last element added to the stack is the first to be removed—following the Last In, First Out (LIFO) principle. As a result, when working with smart contracts, you often need to access data sequentially, even if some of it is not immediately relevant. For example, in the function below, we aim to retrieve the address, but must first read the flags, even though they are not used:

slice parse_sender_address (cell in_msg_full) inline {

var cs = in_msg_full.begin_parse();

var flags = cs~load_uint(4);

slice sender_address = cs~load_msg_addr();

return sender_address;

}

Additionally, the TVM’s state is managed by control registers, with c4 being the most commonly used register in TON smart contracts. The c4 register holds the root of the persistent data, essentially representing the contract’s data section, and this value is stored in a Cell.

As your journey through the TON ecosystem continues, you may establish several “smart contract base camps.” But the question remains: how do you effectively organize communication between them?

Sending Messages in TON

TON employs an actor model for communication between smart contracts. Each smart contract can receive a single message, modify its state, and send one or more messages within a given time frame. This model allows both the entire blockchain and individual contracts to scale, accommodating an unlimited number of users and transactions.

In addition, the TON blockchain and its hosted contracts can receive external messages from other blockchains or the broader web. This capability means that you can send a message to a TON smart contract without needing an on-chain account, enabling smart contracts to process and integrate external data for on-chain operations.

Testing Messages

As we venture further into the ecosystem, we encounter enigmatic stones inscribed with ancient runes….

To test smart contracts that interact with messages, we must first generate the necessary addresses. In TON, objects are described by TL-B schemes, so to determine what a test address should look like, we need to examine the block scheme.

It becomes apparent that the runes on these stones hold valuable information that will guide us on our journey.

To gain a deeper understanding of TL-B, I recommend studying the following resource: TL Language.

The Road Ahead

In this article, we embarked on our journey through the TON ecosystem, starting with the FunC programming language. I hope these initial steps have ignited your enthusiasm to continue exploring and learning more.

Current Overview

In the previous section, we introduced smart contracts on the TON network. We explored the purpose of messages, the role of the c4 register, and discussed testing methods. Now, let’s focus on elements that will enable you to build more sophisticated smart contracts.

Operations and Fees

As we advance in our exploration of the TON ecosystem, we’ll uncover important guidelines for smart contract interactions. Smart contracts within TON communicate with each other by sending internal messages. To streamline these interactions, certain recommendations have been established. A crucial aspect of these recommendations is the inclusion of query_id and op at the start of each message:

- op: Specifies the operation to be performed or the method to be invoked within the smart contract.

- query_id: Used in query-response messages to indicate that a response pertains to a specific query (when sending a reply).

Here’s an example of how it appears:

() recv_internal (int balance, int msg_value, cell in_msg_full, slice in_msg_body) {

int op = in_msg_body~load_int(32);

int query_id = in_msg_body~load_uint(64);

if (op == 1) {

// Handle operation 1

;;

} else {

if (op == 2) {

// Handle operation 2

;;

} else {

// Handle unexpected operations or throw an exception

;;

}

}

}

The more you delve into the TON ecosystem, the more you discover about interacting with its environment. Your team’s account manager suggests he has insights into making your smart contracts more efficient.

The TON network operates using its own cryptocurrency, Toncoin. This digital currency underpins a marketplace for computational resources. Such a marketplace creates economic incentives for participants to validate transactions, fulfill requests, and contribute computing power to the network. Every participant initiating a transaction request must pay fees in Toncoin. Since smart contracts also utilize Toncoin, optimizing them to minimize fees becomes crucial.

In the TON network, transaction fees are composed of several components:

- Storage Fees: Charges for reserving space on the blockchain.

- Inbound Forwarding Fees: Costs associated with processing external messages that are imported into the system.

- Computation Fees: Fees for executing instructions within the TON Virtual Machine (TVM).

- Action Fees: Charges related to handling a list of actions, such as sending messages.

- Outbound Forwarding Fees: Costs for managing outgoing messages.

A straightforward method to lower fees is to employ the inline keyword for functions that are called infrequently, such as once or twice. This approach ensures that, during compilation, these functions are directly inserted at the call site.

The following is an example of how data loading can be handled when it is only required on a one-off basis.

(slice, slice) load_data () inline {

var ds = get_data().begin_parse();

return (ds~load_msg_addr(), ds~load_msg_addr());

}

Understanding Operations (Op)

Testing Operations

As a long-standing member of the TON ecosystem, you are aware that comprehensive testing is essential for all operations.

Testing Operations (Op) with Register c5

To evaluate how operations are executed, we need to determine what actions the smart contract has performed. For this, we utilize register c5.

Register c5 holds the output actions and is represented as a Cell. This register stores outgoing messages from smart contracts. During testing, we will send messages between addresses and examine the c5 register to ensure that all actions are correctly executed.

Please find below an example of the process for extracting a single message from register C5.

(int, cell) extract_single_message(cell actions) impure inline method_id {

;; ---------------- Parse actions list

;; prev:^(OutList n)

;; #0ec3c86d

;; mode:(## 8)

;; out_msg:^(MessageRelaxed Any)

;; = OutList (n + 1);

slice cs = actions.begin_parse();

throw_unless(1010, cs.slice_refs() == 2);

cell prev_actions = cs~load_ref();

throw_unless(1011, prev_actions.cell_empty?());

int action_type = cs~load_uint(32);

throw_unless(1013, action_type == 0x0ec3c86d);

int msg_mode = cs~load_uint(8);

throw_unless(1015, msg_mode == 64);

cell msg = cs~load_ref();

throw_unless(1017, cs.slice_empty?());

return (msg_mode, msg);

}

In this function:

- Parse Actions List: The function begins by parsing the actions cell into a slice object.

- Validate Structure: It checks the expected number of references and validates the presence of required fields.

- Extract Data: The function extracts and validates the action_type, msg_mode, and msg from the parsed data.

- Return Results: Finally, it returns the message mode and the message itself.

Lesson on Testing Operations

HashMaps

As smart contracts become more intricate, managing data efficiently, especially with respect to time, becomes crucial. This is where hashmaps, also known as dictionaries, come into play.

A hashmap is a data structure typically organized as a tree. It associates keys with values of any type, allowing for fast retrieval and modification. In FunC, hashmaps are implemented as cells.

The FunC standard library offers various functions to work with hashmaps efficiently. For instance, to add data to a hashmap, you can use the dict_set function. This function sets the value linked with a specific key index (of n-bit depth) in the dictionary to a slice and returns the updated dictionary.

Here’s an example of using dict_set:

dic~dict_set(256, key, in_msg_body);

Working with Hashmaps and Loops

To effectively manage hashmaps, loops are essential tools:

Loops are commonly employed when dealing with hashmaps. FunC provides three types of loops: repeat, until, and while.

Among these, the until loop is particularly useful for hashmaps. This is because many hashmap functions return a flag that makes it easy to determine when to end the loop.

Introduction to Hashmaps

Testing Hashmaps

When testing contracts that involve time-based logic, it’s crucial to utilize the c7 register. For effective testing, we need to create a helper function to manage time within the smart contract.

The c7 register holds the root of temporary data and is represented as a Tuple.

The helper function will enable us to set any required time value into this register. Here’s an example of how the helper function might be structured:

tuple get_c7_now(int now) inline method_id {

return unsafe_tuple([unsafe_tuple([

0x076ef1ea, // Magic number

0, // Actions

0, // Messages sent

now, // Unix time

1, // Block timestamp

1, // Transaction timestamp

239, // Random seed

unsafe_tuple([1000000000, null()]), // Remaining balance

null(), // Self reference

get_config() // Global configuration

])]);

}

Since the smart contract includes both value storage and retrieval logic, it’s necessary to test the data from prior tests. This isn’t supported directly by the standard FunC library, but toncli provides a solution: In the toncli test descriptions, the get_prev_c4 and get_prev_c5 functions are available to retrieve the c4 and c5 cells from earlier tests.

To simplify working with tuples from the stack, the standard library includes the following functions:

- first — Retrieves the first element of a tuple.

- second — Retrieves the second element of a tuple.

Lesson on Testing Hashmaps

Next Steps

Congratulations on making substantial progress in your journey. In the upcoming section, we will explore token standards and NFTs within the TON ecosystem.

As our journey progresses, you come across a monumental edifice, a repository of wisdom… Anticipating your inquiries, the keeper of this repository directs you to the Tokens section.

Understanding Tokens

Cryptocurrency tokens represent units of digital value within a given network. It’s crucial to understand that tokens are not necessarily cryptocurrencies but rather entries recorded on the blockchain, managed through smart contracts. These smart contracts track account balances and enable token transfers between accounts.

While it may seem straightforward to create a smart contract that handles balance storage and token transfers, the challenge arises when every developer designs their own system from scratch. This would complicate integration for applications such as wallets, games, and analytics platforms.

To address this, blockchain networks have established standards developed collaboratively with the community.

The prospect of creating your own tokens for future use in the TON ecosystem prompts you to consult the guardian once more. You inquire: Where can I find the relevant standards?

TEP and Standards

Blockchains typically feature dedicated pages on GitHub or similar platforms where you can propose new standards or modifications. For TON, this is managed through a specific GitHub repository.

It’s crucial to remember that these repositories are not forums for open discussion but rather formal places for submitting and reviewing proposals. Ensure your contributions are well-considered and relevant to the repository’s purpose.

The first standard we’ll examine is the token metadata standard. This standard is essential for applications such as wallets and marketplaces, as it streamlines the process of retrieving and displaying token information. By standardizing how token data is represented, this standard facilitates a consistent user experience across different platforms.

Understanding Tokens in TON

Since tokens are implemented as smart contracts, they can potentially contain errors or vulnerabilities. It is important to thoroughly examine smart contracts before utilizing them.

After exploring Web3 for some time, you may have encountered tokens in various other ecosystems, but TON has distinct differences…

Differences in TON Tokens

The architecture of token smart contracts in TON diverges significantly from that of other networks. Unlike other systems, TON operates asynchronously, follows the actor model for interactions, and uses sharding for scaling.

A major distinction from other networks’ standards is the absence of a single smart contract that handles all functions. For instance, when deploying an NFT collection (which we will explore in more detail later), each item in the collection is managed by a separate smart contract, with an additional contract governing the entire collection.

For example, if you deploy a collection of 10,000 items, you will end up with 10,001 individual smart contracts.

You might wonder why this approach was adopted. In summary:

- Predictable Gas Consumption: This design allows for more predictable gas usage.

- Scalability Considerations: This approach does not inherently scale.

For a comprehensive explanation, refer to the NFT standard documentation.

Types of Tokens

Tokens can be categorized based on their fungibility, which is one way to classify them.

Fungible Tokens are assets that are interchangeable and identical in value. Each token within this category is equivalent to every other token of the same type, making them easily exchangeable. In TON, the standard for fungible tokens is the Jetton.

Non-Fungible Tokens represent assets that are unique and cannot be substituted with another asset. Each non-fungible token is a distinct digital certificate with a mechanism for transferring its ownership. In TON, the standard for non-fungible tokens is the NFT Standard.

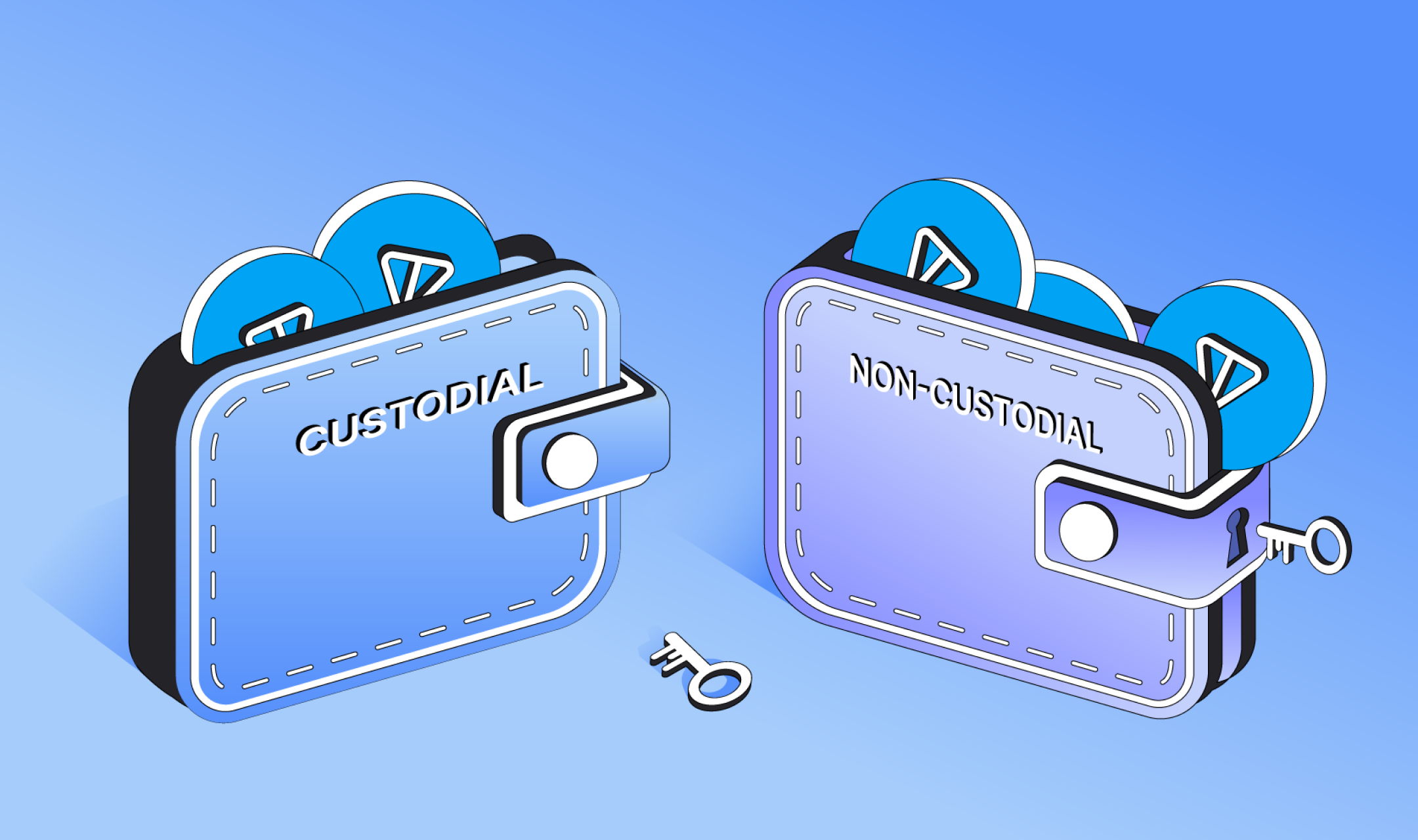

Jetton

The standard for fungible tokens is known as Jetton. According to this standard, a Jetton token requires the deployment of two distinct types of smart contracts:

- Master Contract: This primary smart contract is responsible for minting new Jettons, tracking the overall supply, and providing general information about the token.

- Contract Wallets: These smart contracts handle the balance of each user’s Jettons.

For instance, if you issue a Jetton with a total supply of 200 tokens distributed among 3 users, you would need to deploy 4 contracts: one master contract and three contract wallets.

To help you grasp the standard and its implementation, I’ve prepared a lesson that covers both the theoretical aspects of the standard and practical examples of implementing the master contract and Jetton wallets.

NFT Standard

NFTs (Non-Fungible Tokens) in TON follow their own specific standard. Unlike fungible tokens, where the Jetton standard applies, NFTs are structured differently: each NFT item and NFT collection is managed through separate smart contracts.

NFTs offer an excellent way to document your FunC journey, but there are a few critical questions to address:

- How to obtain a complete link to the content when there’s no unified list within the smart contract?

- How to determine the address of the NFT or Token smart contract and what kind of StateInit allows for this?

Understanding StateInit

To deploy a smart contract on the network, the code and data for the contract are compiled into a StateInit structure. The address of the new smart contract is derived from the hash of this StateInit structure. An external message is then generated with a destination address matching the new smart contract’s address. This message includes the appropriate StateInit data and a non-trivial payload (signed with the correct private key).

In practical terms, this process means we can derive the address of a token’s smart contract by looking at the address where the tokens need to be sent. Essentially, by using the address and wallet code, we can reconstruct the StateInit of the wallet and retrieve the necessary address for the token wallet.

This approach is feasible because hashing functions are deterministic: they produce a unique hash for different inputs, and the same input will consistently yield the same hash.

NFT Item Content

Imagine you need to retrieve the address of a collection item, such as a link to an image. The process might seem straightforward: you use a Get-method to fetch the information. However, according to the NFT standard in TON, this approach will only yield a partial link, known as the individual item content.

To obtain the complete content, follow these steps:

- Use the get_nft_data() method of the item to retrieve the element index, individual content, and the initialization indicator.

- Verify if the item is initialized (details on this can be found in Lesson 10, which covers the NFT standard).

- If the item is initialized, use the get_nft_content(int index, cell individual_content) method of the collection to obtain the full content (complete address) for the specific item.

To clarify the standard further, I have prepared a lesson on this topic.

Conclusion

This series marks the end of our journey through FunC. I will continue to share new lessons on my channel, which may be valuable if you are considering starting development on TON.

Transacting with Toncoin: A Guide to Payments on the TON Network

On the TON blockchain, block generation occurs approximately every 5 seconds. This timing remains consistent even as network demand increases. Essentially, within those 5 seconds, the network can handle millions of transactions.

Additionally, TON’s blockchain features remarkably low transaction fees.

This setup is generally sufficient for most use cases.

In contrast, traditional banking apps may also process money transfers within seconds, but this is often masked by visual animations.

Reducing block times to, say, 500 milliseconds—like some other blockchains aim to—seems unnecessary for TON. Although technically feasible, such a reduction would require network nodes to handle and store a vast amount of data, which we believe is impractical. Prioritizing nominal performance metrics over practical efficiency is not ideal.

However, there are scenarios where extremely rapid transaction speeds and minimal fees are crucial.

For instance, paying for internet data through TON Proxy or TON Storage might involve fees as low as 0.000000001 TON per kilobyte (these figures are illustrative). Thus, downloading a 1GB file could involve millions of microtransactions, totaling approximately 0.01 TON.

To address this, Payment Channels have been introduced.

Payment Channels

Payment channel technology, also known as the Lightning Network, involves the following steps:

- Establishing the Channel: Two parties agree to conduct numerous transactions between themselves. They create a dedicated smart contract on the blockchain to which they send their initial deposits. For instance, Alice and Bob set up a payment channel, with Alice depositing 5 TON and Bob depositing 1 TON.

- Off-Chain Transactions: Alice and Bob can then carry out transactions between themselves off the blockchain. These transactions are signed with cryptographic algorithms to ensure security and validity.

- Closing the Channel: When Alice and Bob conclude their transactions, they finalize their balances and submit them to the smart contract. This contract then distributes the funds based on their final balances. For example, Alice might receive 4 TON and Bob 2 TON.

- Cost Efficiency: All transactions within the channel are processed off-chain, resulting in no transaction fees and immediate execution. Network fees are only incurred when opening and closing the payment channel.

- Contract Assurance: The smart contract ensures proper functioning of the channel. If one party attempts to act dishonestly or disappears, the other party can close the channel independently and claim the funds by providing mathematical proof.

This system allows for efficient and cost-effective transactions while maintaining security and trust.

Resources

A detailed technical overview of payment channels is available in Chapter 5 of the white paper:TON White Paper.

For pre-built smart contracts related to payment channels, visit:Payment Channels on GitHub.

Deep cryptographic knowledge is not required to work with payment channels. You can utilize existing SDKs:

- JavaScript SDK:TON Web SDK

- Example of implementing a payment channel:Payment Channels Example

Payment Channel Networks

As technology evolves, payment channels will be able to form networks off-chain, allowing multiple parties to participate in a single channel. Current smart contracts are already equipped to facilitate integration into such off-chain networks.

Summary

The TON blockchain offers fast transactions and low fees. For extremely rapid transaction speeds and numerous transactions with no fees, payment channels provide an effective solution.

The TON Payments technology has broad applications across various domains, including internet data payments, streaming services, gaming, and decentralized finance (DeFi).

A few years later, in 2018, the ERC-721 standard was launched for NFTs, which serve as proof of ownership for digital assets.

These standards have led to the rise of decentralized finance (DeFi). In the DeFi ecosystem, operations such as trading, buying, and selling digital assets are executed entirely through blockchain-based smart contracts.

Unlike centralized exchanges, where you temporarily relinquish control of your assets to the platform, decentralized exchanges and DeFi services offer protection against potential risks. Centralized platforms can be vulnerable to hacking, system failures, or data center issues, which can result in the loss of your funds. Additionally, exchanges may impose restrictions on your assets without justification.

This has led to a growing trend towards decentralized exchanges (DEXs), liquidity pools, and other DeFi solutions that offer resilience against these vulnerabilities.

Scalable DeFi Solutions

One of TON’s primary objectives is to facilitate widespread adoption of decentralized technology.

Interest in blockchain and cryptocurrency continues to grow, but these technologies are still utilized by only a small fraction of the global population.

To achieve mass adoption and support billions of users and transactions, we have developed an innovative approach to token and DeFi design.

In contrast to other blockchains, where a token is typically represented by a single smart contract, TON employs a more scalable model.

For instance, the USDT token on Ethereum manages the balances of 4 million users within a single smart contract. Similarly, the Ethereum network’s Bored Ape NFT collection, consisting of 10,000 items, is housed in a single contract.

This approach is commonly used across various blockchain projects to maintain compatibility with Ethereum. However, as the user base grows, this single-contract model becomes a bottleneck, potentially leading to system failures under heavy loads.

TON’s architecture avoids these limitations by decentralizing the management of tokens and NFTs. Each NFT in a collection is assigned its own smart contract, and individual token balances are managed through separate user wallets.

This design enables direct interaction between smart contracts, distributing the load across the network and ensuring balanced performance even as the number of users and transactions scales.

TON also incorporates an infinite sharding mechanism, which splits the network into subchains to handle increased demand efficiently. This flatter load distribution enhances the effectiveness of the sharding process.

Minting an NFT on TON is approximately 500 times cheaper than on Ethereum. Despite fluctuations in the value of Toncoin, network fees remain stable.

Thanks to its distributed architecture, TON maintains high transaction speeds even as the volume of transactions increases dramatically.

Innovation and Advancement

TON has introduced novel concepts that were not present in earlier blockchain technologies.

In the past three months, we have been diligently searching for effective methods to implement scalable DeFi solutions within the TON ecosystem.

Initially, we faced challenges in adapting tokens and DeFi to The Open Network due to the need to rethink approaches for new distributed, asynchronous paradigms.

However, we eventually succeeded. We are now excited to unveil established standards and practical examples of smart contract implementations for Fungible, Semi-Fungible, and Non-Fungible Tokens, as well as contracts for marketplaces and ICOs.

These resources are available for creating DeFi services capable of handling a vast user base. New methods bring new opportunities, and we have already begun exploring them.

We believe that distributed, asynchronous DeFi on TON represents a significant step toward widespread adoption of decentralized technologies.

Initially, the network protocols were specifically designed for the TON blockchain to enable effective communication and data exchange between nodes. Today, the network offers solutions that are so robust and versatile that they collectively represent a new generation of internet infrastructure.

Even when considered separately from the TON blockchain, the TON network stands out as a fully decentralized, secure, and private computing network, similar to TOR or the I2P (Invisible Internet Project).

The TON network is intricately linked with the TON blockchain, its native Toncoin cryptocurrency, and various TON services. This integration creates a powerful synergy, advancing the network’s technology to unprecedented levels.

TON Network Features

- Decentralized: Operates as a peer-to-peer network without any centralized servers.

- Robust: The network remains functional even if some nodes go offline.

- Anonymous: Identifying a node’s IP address is either impossible or extremely challenging.

- Encrypted: All data transmitted between nodes is encrypted.

The network utilizes UDP/IP and TCP/IP protocols for internet communication. For a more in-depth technical overview of these protocols, refer to Chapter 3 of The Open Network’s white paper.

The TON blockchain relies on the TON network. Since the project’s launch three years ago, the nodes (including validators and servers) have effectively communicated through the TON network, demonstrating its stability and efficiency.

As blockchain operations grow in complexity, more advanced network solutions will be necessary. The TON network is well-suited to meet the demands of next-generation blockchains. For instance, when the TON blockchain scales into multiple sub-blockchains to handle high throughput, each sub-blockchain operates within its own dedicated sub-network.

TON Sites

The TON blockchain extends beyond just blockchain applications. From now on, you can set up a web server and host your site on the TON network—essentially creating a TON Site.

Mandatory Encryption and Data Authenticity Verification

In the early days of the internet, data exchanges—such as chat messages—were transmitted in plain text and could be intercepted by anyone on the network. There was no way to ensure that the data wasn’t altered during transmission.

The advent of HTTPS changed this by providing encryption and authentication for data.

Although HTTPS has become widespread over the past 15 years, approximately 20% of websites still do not use this protocol by default.

Consequently, there remains a risk that users’ data might be transmitted through unencrypted channels.

To address this, the TON network enforces mandatory encryption and automatically verifies the authenticity of all data traffic.

Eliminating the Need for Certification Authorities

To secure data and verify its authenticity, traditional websites require special certificates. While you can technically generate these certificates yourself, they may not be trusted as highly as those issued by certification authorities. These authorities, which may charge a fee or offer free services, are supposed to verify the site owner, but often even costly extended certificates lack proper diligence.

In essence, many certification authorities fall short of their responsibilities.

TON Sites simplify this by incorporating built-in cryptographic measures to ensure data encryption and authenticity. Your site will be secure immediately, without the need to engage with certification authorities.

Say Goodbye to Domain Name Registries

For traditional websites, domain names are rented from commercial entities, essentially centralized domain name registries.

A major issue with this system is that your domain name can be suspended or revoked for arbitrary or unknown reasons, or even by mistake.

Anyone can report to a domain name registry that your website is involved in illegal activities. Even if this claim is false, the registry’s staff might be forced to suspend your site without a full investigation into the situation, leading to significant trouble and financial losses.

TON Sites eliminates this problem by using TON DNS, a completely decentralized domain name system.

Unlike traditional registries, which require substantial payments to cover administrative costs, TON DNS only requires a minimal annual micropayment as a token of domain ownership.

Connecting a TON Site to a Domain

Subdomains

Just like with conventional websites, you can create subdomains for your TON Sites using TON DNS.

To achieve this, you can utilize any compatible smart contract.

We have developed several pre-built smart contracts for this purpose.

With the manual-dns smart contract, a site owner can assign any page to any subdomain.

For service providers, the auto-dns smart contract is available. This allows users to register their own subdomains by paying a network fee and an optional service fee.

For example, a social network like place.ton enables Alice to register a personal subdomain, such as alice.place.ton, by paying a small amount of Toncoin.

Additionally, you can conduct an auction for NFT subdomains, similar to the initial distribution of “.ton” domains.

TON WWW

Assigning a Wallet to Your Domain

Imagine you visithttp://foundation.ton and wish to contribute 10 TON to support network development. How would you proceed?

It’s straightforward: Simply transfer 10 TON directly from your wallet to the domain address. No additional payments or details are necessary.

The same applies to subdomains. For instance, if you visit Alice’s personal page at alice.place.ton on the place.ton social network, you can send 10 TON as a gift by entering alice.place.ton as the recipient address. Alice will receive the TON in her cryptocurrency wallet, which she linked to her account during its creation.

Authentication

On the traditional internet, users must register and create unique passwords for each site. This process can become cumbersome and inconvenient, even with the use of password managers. Many users resort to using the same password across multiple sites, which poses significant security risks.

Additionally, logging in often requires an email address or phone number, which can attract unwanted advertisements.

With TON, there’s no need for registration. You can log in to websites or applications using your TON-based crypto wallet, eliminating the need to share your email address or create multiple passwords for different services.

Hyperlinks

The World Wide Web consists of interconnected web pages where text can include hyperlinks. These links allow users to navigate seamlessly from one resource to another or to perform actions such as opening an email client.

TON Sites function similarly to traditional websites, but they are accessed through the TON network. Their URLs resemble those of regular websites but end with “.ton” — for example,http://foundation.ton.

TON uses a distinct format for hyperlinks to trigger actions:

ton://domain/<method>?<field1>=<value1>&<field2>;..

For instance: ton://EQCD39VS5jcptHL8vMjEXrzGaRcCVYto7HUn4bpAOg8xqB2N/transfer?amount=1&text=hello

Clicking this link will launch the TON crypto wallet, pre-filling the recipient’s address, the amount of crypto, and any additional information.

Web developers can also create scripts that interact with your TON wallet or TON browser extension.

This framework forms TON WWW: a network of interconnected web pages and services on TON, accessible through a TON crypto wallet and web browser.

TON Proxy

To access the TON network, users must connect through a specific entry point known as an “entry proxy.”

Currently, the TON Foundation provides public entry points.

These public entry points should be used with HTTP for testing purposes only, as traffic outside the TON network is not encrypted in this case.

Tech-savvy users can already set up entry proxies on their devices. In the near future, this functionality will be simplified and made available to all users via a straightforward application.

Using a Browser

Since TON Proxy supports HTTP Proxy, you can configure your browser or system settings to use a public TON entry proxy as your proxy server.

This setup allows you to access “.ton” sites directly in your browser, just like any other website.

For detailed instructions on configuring TON Proxy across different browsers, refer to the provided guide.

Wallets

Simplifying access is always a goal. Several TON wallets are working on integrating TON Proxy directly into their apps, eliminating the need for additional software.

Currently, this functionality is available via the MyTonWallet Google Chrome extension: switch to TON Proxy, and your browser will be able to access TON sites.

In the near future, this feature will also be incorporated into the standard TON Chrome Extension, Tonkeeper, and other TON wallet applications.

Upcoming Developments

We are anticipating two major updates focused on enhancing privacy and expanding decentralized finance capabilities.

TON Proxy 2.0 — Enhanced Privacy

A major concern with the current internet is that both users’ IP addresses and website IPs are exposed and easily traceable.

With the TON Proxy 2.0 upgrade, users will have the ability to set up intermediary proxy nodes within the TON network. This update introduces garlic routing, which routes data through a series of intermediary nodes, effectively concealing the IP addresses of both users and sites.

Anyone will have the opportunity to operate these intermediary nodes, similar to TOR or I2P. This will enable widespread experimentation with the technology.

Site Security

Many websites, especially beyond the homepage, rely on services like CloudFlare or Akamai to obscure their IP addresses and defend against DDoS attacks and breaches.

While these services are effective, they are centralized commercial entities. These companies control a significant portion of the internet, and a major issue with one can result in widespread outages, impacting a large part of the web.

We believe that utilizing decentralized nodes via TON Proxy offers a more robust and reliable solution for protecting a site’s IP address.

User Privacy Protection

Typically, a user’s IP address is visible and can be exploited by hackers or corporations to gather extensive information about online activities. Corporations can track your browsing history even without user accounts by analyzing IP addresses.

TON Proxy addresses this issue by rerouting internet traffic through multiple intermediary proxies, ensuring that the destination site or service cannot see your real IP address.

With the introduction of TON Proxy 2.0, complete anonymity will be achievable within the TON network.

TON Proxy 3.0 — Advancing Decentralized Finance

In the third phase, the decentralized Toncoin economy will be integrated with intermediary TON Proxies to enhance user privacy and site security.

Payments will be processed through the Payment Network technology, developed in Q2 2022. Intermediary proxy nodes will earn micropayments for handling internet traffic — for instance, for each 128 KiB package — which will be deducted from users’ crypto wallets.

This decentralized payment model will allow independent administrators to manage intermediary proxy nodes globally, improving the network’s efficiency, scalability, and stability.

We believe that the lack of financial incentives has hindered the scalability of networks like I2P and TOR over the past 20 years.

Conclusion

The current internet operates on protocols dating back to the 1990s, and some even from the 1980s. While these foundational technologies have served us well, they are increasingly inadequate in addressing modern privacy and security demands.

As technology becomes more integrated into our daily lives — through surveillance cameras, fitness trackers, and automated checkout systems — the risks to personal information grow. Misuse of this data can lead to severe consequences, including threats to personal safety.

Moreover, the concentration of power among major corporations has made the internet more fragile and privacy-compromising, as vast amounts of user data are collected, sold, or exposed in data breaches.

Today, we take a significant step towards addressing these challenges by introducing the TON network, featuring TON Proxy and TON Sites with TON DNS integration. These decentralized, secure, and user-friendly services offer a superior alternative to the traditional web.

The Traditional Internet (Web2)

The term Web 2.0 refers to the conventional internet that we are familiar with today. This version of the internet is predominantly managed by major corporations like Google. These entities are primarily driven by the goal of maximizing profits for their shareholders, with the welfare of users being a secondary consideration.

Consider a Web2 service like Gmail. As a user of Gmail, you are not on equal footing with Google, the service provider. This phenomenon is known as centralization. In centralized systems, users do not possess genuine ownership. For example, if Google deems that you have violated its terms of service, it has the authority to revoke your access to your email account. Centralized services are also permission-based; you need explicit approval to use the service and send emails. If Google categorizes your email as spam, it is under no obligation to deliver it.

Centralization relies on trust. Users grant power to companies like Google based on their confidence in these entities to handle this power responsibly.

The Next Generation Internet (Web3)

Many of us consider the Internet as a shared resource, a medium that connects the world into a cohesive global community and facilitates communication and collaboration. We envision a future where control shifts from large corporations to individual users. Web3 embodies this vision, representing the anticipated next phase in the evolution of the Internet.

In this vision, users of Web3 services have the same level of authority as the creators of those services. This principle, known as decentralization, ensures that users have genuine ownership—not just of their data but also of digital assets. For instance, your cryptocurrencies like Bitcoin or Toncoin are fully yours and cannot be seized by anyone. Decentralized services also operate on a permissionless basis, meaning you can transfer your Toncoin or perform other transactions without needing approval from anyone else. No one can block or censor your actions.

Decentralization enables systems to be trustless. With no central authority, there is no risk of abuse of power that could harm users.

Blockchain Technology

The concept of Web3 appears promising, but how practical is it? For developers, creating services where the user and provider are on equal footing can be challenging. Typically, developing a service involves setting up a backend that operates on a server owned by the developer. This server can be modified or even shut down by the developer, leading to an unequal relationship. Traditional backend servers are centralized.

Blockchain technology was designed to address this issue, enabling the creation of decentralized backends. In a blockchain system, the backend is maintained by its users. This equal relationship means that any user interested in contributing to the backend can do so, with the blockchain functioning as a cooperative effort among its participants.

Collaboration in blockchain networks is managed through consensus. For an outcome to be validated, it must be agreed upon by a majority of users. This process makes blockchains less efficient compared to traditional centralized servers, as each calculation requires confirmation from multiple participants. Additionally, operating blockchains can be more costly due to their inherent inefficiencies.

The Token

We previously discussed how results are validated through voting. But how does this voting system function? Is it a straightforward “one user, one vote” model like in traditional elections? In practice, this approach is impractical on the Internet due to a challenge known as the Sybil attack. It’s easy to create numerous fake identities online. Given the decentralized nature of Web3, we lack a centralized authority to differentiate between genuine and fraudulent users.

A common decentralized approach to addressing this issue is to tie voting power to a token. For instance, if you possess 10 tokens, you are granted 10 votes. Unlike fake identities, tokens are difficult to counterfeit, making it easy to distinguish legitimate tokens from fraudulent ones. The TON blockchain utilizes Toncoin, while the Ethereum blockchain uses Ether. This implies that every blockchain operates as an economy in its own right. Tokens serve as an incentive to ensure that the decentralized network remains aligned with its goals.

Network Validators

Blockchains function as networks managed by a group of users. Those who handle the core operations and participate in the consensus process are known as validators. The influence of each validator in the voting process is proportional to the number of tokens they hold. To ensure validator integrity, they typically must stake their tokens. Should the consensus process determine a validator is acting dishonestly, their staked tokens may be forfeited as a penalty. This system of governance is known as proof-of-stake.

Being a validator is demanding, requiring the operation of a blockchain node on a personal server and staking a significant amount of tokens. Users with fewer tokens who wish to participate can delegate their tokens to a more prominent validator. These users are referred to as nominators.

Transaction Fees

As previously mentioned, blockchains function as economies. The infrastructure necessary for validators is not free, so they must be compensated for their services. Payments are made using the blockchain’s native token. For example, on the TON blockchain, users pay fees with Toncoin. Validators earn Toncoin for processing transactions and running applications on the blockchain.

When a user performs an action on the blockchain, they initiate a transaction that includes a fee known as gas. This concept is analogous to a car needing fuel to operate. Users must authorize transactions using their blockchain wallets, which ensures that only the wallet’s owner can approve the payment of gas and finalize the transaction.

Decentralized Applications (Dapps)

As we previously mentioned, blockchains are designed to operate decentralized backends. These blockchain-based services are commonly referred to as apps, or more specifically, decentralized apps, abbreviated as dapps. Developers create dapps, which are executed by network validators. Users engage with dapps by sending transactions to them. In a decentralized system, the developer of a dapp has the same status as its users, with no special privileges.

To illustrate this, consider a traditional Web2 service such as Google Search. The provider of this service, Google, controls search result rankings for user benefit but can also promote its own products. For instance, when searching for “storage,” Google might prioritize “Google Drive” over “Dropbox.” In a Web3 version of Google Search, the developer would not have the ability to favor their own products in the search results.

Smart Contracts

In the Web2 world, services like Google Search come with terms of service. If users feel wronged, they can seek judicial resolution. Web3 operates differently, lacking centralized authority figures like judges. Instead, the code governs the rules. In this context, the code of a dapp serves as the binding agreement between its users. Unlike traditional legal contracts, this code executes consistently and is not open to interpretation.